|

CMS has approved risk adjustment for diagnosis captured via telehealth with a brief press release for all encounters that would meet risk adjustment criteria had they been face to face. As this rule is novel in its scope and application we’re hearing quite a bit of chatter and confusion around the nuances of implementing these new policies. We’ve reached out to our experts and have compiled a list of Do’s and Don’ts in the hopes of resolving some of the confusion. Telehealth Risk Adjustment Do’s

Telehealth Risk Adjustment Don'ts

1 Comment

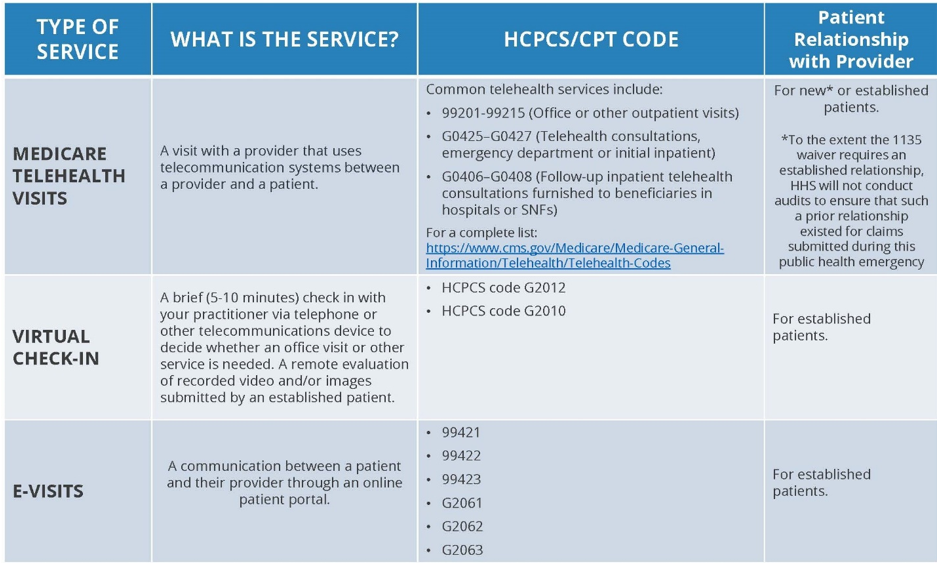

Centers for Medicare & Medicaid Services (CMS) has broadened access to Medicare telehealth services so that beneficiaries can receive a wider range of services from their doctors without having to travel to a healthcare facility. These policy changes build on the regulatory flexibilities granted under the President’s emergency declaration. CMS is expanding this benefit on a temporary and emergency basis under the 1135 waiver authority and Coronavirus Preparedness and Response Supplemental Appropriations Act. The benefits are part of the broader effort by CMS and the White House Task Force to ensure that all Americans – particularly those at high-risk of complications from the virus that causes the disease COVID-19 – are aware of easy-to-use, accessible benefits that can help keep them healthy while helping to contain the community spread of this virus. EXPANSION OF TELEHEALTH WITH 1135 WAIVER: Under this new waiver, Medicare can pay for office, hospital, and other visits furnished via telehealth across the country and including in patient’s places of residence starting March 6, 2020. A range of providers, such as doctors, nurse practitioners, clinical psychologists, and licensed clinical social workers, will be able to offer telehealth to their patients. KEY EXCEPTIONS to note for the duration of the COVID-19 Public Health Emergency

|

AuthorsPhysicians, Attorneys, Coders, Billers, Archives

April 2020

Categories |

RSS Feed

RSS Feed